An exit strategy: What Is It?

An exit strategy is a strategic plan that outlines how a business owner or investor intends to liquidate their investment in a company or fully withdraw from an ongoing business venture. This carefully crafted plan serves as a roadmap for maximizing returns and minimizing risks associated with the disposal of assets, whether it's selling the entire business, merging with another entity, or going public through an initial public offering (IPO).

1. Purpose of an Exit Strategy:

-

Objective: An exit strategy is designed to provide a clear pathway for stakeholders to cash in on their investment or transition out of a business endeavor.

-

Applications: Relevant for entrepreneurs, investors, and business owners planning for the eventual endgame of their involvement in a venture.

-

Benefits: Minimizes uncertainties, facilitates smooth transitions, and maximizes returns on investment.

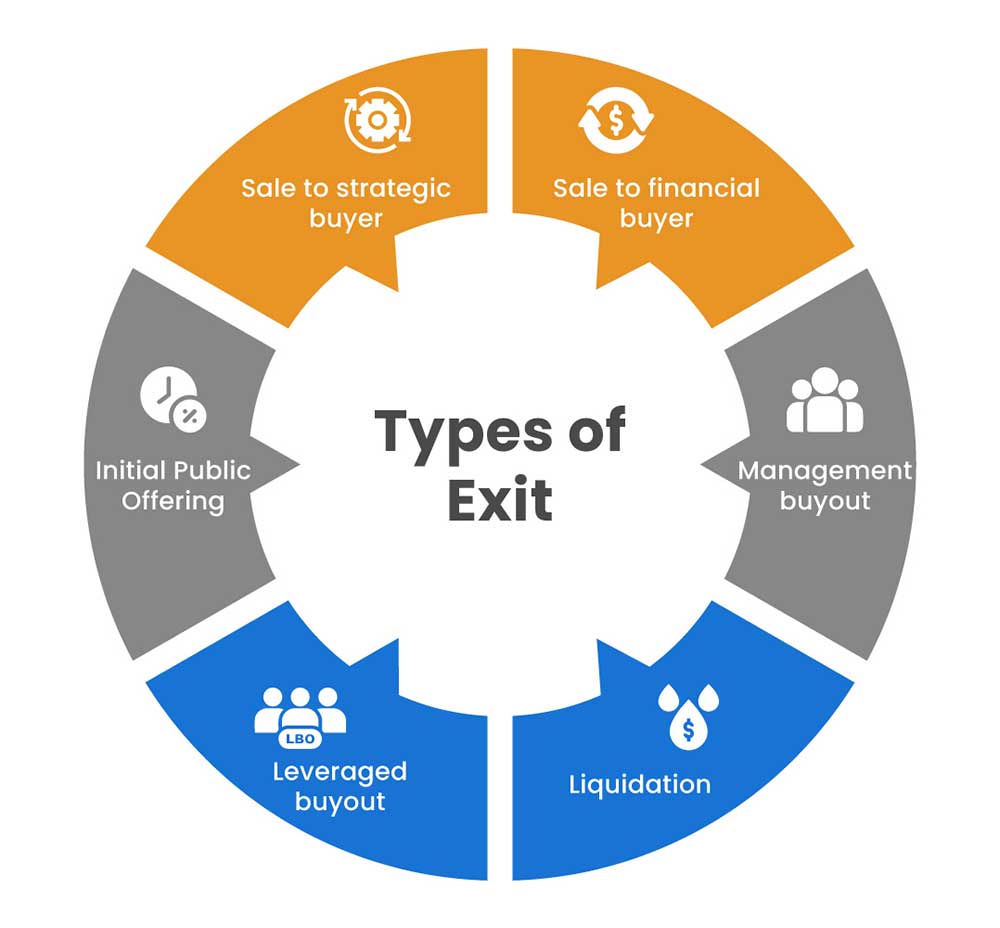

2. Types of Exit Strategies:

a. Selling the Business:

-

Overview: Involves selling the entire business or a significant stake to another company or an individual.

-

Benefits: Offers a direct liquidity event, and the value is determined by negotiations or market forces.

b. Merger or Acquisition:

-

Overview: Involves merging with another company or being acquired by a larger entity.

-

Benefits: Can provide synergies, access to additional resources, and a premium valuation for the business.

c. Initial Public Offering (IPO):

-

Overview: Involves taking the company public by listing its shares on a stock exchange.

-

Benefits: Provides access to public capital markets, liquidity for shareholders, and increased visibility.

d. Management Buyout (MBO) or Employee Stock Ownership Plan (ESOP):

-

Overview: In an MBO, current management buys the business, while an ESOP involves employees becoming partial or full owners.

-

Benefits: Maintains continuity, rewards key employees, and provides an exit strategy for the owner.

e. Liquidation:

-

Overview: Involves selling off assets, paying off debts, and distributing remaining funds to stakeholders.

-

Benefits: Suitable when the business is no longer viable or when maximizing immediate cash is the primary goal.

3. Factors Influencing Exit Strategies:

a. Business Lifecycle:

-

Influence: Early-stage startups might opt for acquisition, while mature companies may consider IPOs.

-

Consideration: The business's current stage plays a pivotal role in determining the most suitable exit strategy.

b. Market Conditions:

-

Influence: Economic conditions, industry trends, and market demand impact the feasibility and timing of various exit strategies.

-

Consideration: Businesses often align their exit plans with favorable market conditions to maximize valuation.

c. Owner's Objectives:

-

Influence: The owner's financial goals, lifestyle preferences, and desire for continued involvement in the business influence the chosen exit strategy.

-

Consideration: Personal objectives play a crucial role in tailoring the exit plan to the owner's aspirations.

4. Importance of Exit Planning:

a. Maximizing Value:

-

Objective: Proper exit planning aims to maximize the value of the business at the time of exit.

-

Consideration: Strategies such as enhancing profitability, streamlining operations, and strategic positioning contribute to a higher valuation.

b. Minimizing Risks:

-

Objective: Exit planning helps identify and mitigate potential risks associated with the chosen exit strategy.

-

Consideration: Addressing legal, financial, and operational risks ensures a smoother exit process.

c. Ensuring Continuity:

-

Objective: Exit planning includes measures to ensure business continuity during and after the exit.

-

Consideration: Succession planning, knowledge transfer, and client retention strategies contribute to ongoing business success.

In summary, an exit strategy is a critical component of a business's overall strategy, providing a roadmap for stakeholders to exit an investment or business venture. Whether aiming for a lucrative sale, a strategic merger, or a public listing, a well-defined exit strategy aligns with the goals of the business and its stakeholders, ensuring a smooth transition and optimal outcomes.

5. Implementation Strategies:

a. Timely Execution:

-

Importance: Timely execution is crucial to capitalize on favorable market conditions and ensure a smooth transition.

-

Execution: Careful planning and proactive execution contribute to the success of the chosen exit strategy.

b. Professional Guidance:

-

Importance: Seeking advice from financial advisors, legal experts, and industry specialists is essential for navigating complex exit processes.

-

Execution: Engaging professionals ensures compliance with regulations, minimizes risks, and maximizes returns.

c. Valuation Optimization:

-

Importance: Maximizing the valuation of the business is a primary objective in exit planning.

-

Execution: Employing strategies such as improving financial metrics, enhancing operational efficiency, and showcasing growth potential contributes to a higher valuation.

6. Challenges and Mitigations:

a. Market Volatility:

-

Challenge: Economic uncertainties and market fluctuations can impact the success of an exit strategy.

-

Mitigation: Diversifying risk, staying informed about market trends, and building flexibility into the exit plan help mitigate the impact of volatility.

b. Negotiation Complexities:

-

Challenge: Negotiating terms with potential buyers or investors can be intricate.

-

Mitigation: Engaging experienced negotiators, conducting thorough due diligence, and having a clear understanding of the business's value enhance negotiation outcomes.

c. Emotional Considerations:

-

Challenge: Owners may face emotional challenges when parting with a business they've nurtured.

-

Mitigation: Acknowledging emotional aspects, seeking support, and maintaining focus on the strategic objectives help overcome emotional hurdles.

7. Post-Exit Considerations:

a. Financial Planning:

-

Importance: Post-exit financial planning ensures that the proceeds are managed wisely to meet long-term financial goals.

-

Execution: Engaging financial advisors and considering investment options contribute to effective financial planning.

b. Legacy and Reputation:

-

Importance: Preserving the company's legacy and reputation is vital for stakeholders and the exiting owner.

-

Execution: Clear communication, fulfilling commitments, and supporting a smooth transition contribute to maintaining a positive legacy.

c. Non-Compete Agreements:

-

Importance: Non-compete agreements prevent the exiting owner from competing with the business after the exit.

-

Execution: Carefully drafting and negotiating non-compete clauses with legal guidance safeguards the business's future.

8. Continuous Evaluation:

a. Ongoing Assessment:

-

Importance: Continuous evaluation of the business landscape and personal objectives ensures adaptability.

-

Execution: Regularly revisiting the exit strategy, adjusting to changing circumstances, and realigning with goals contribute to long-term success.

In conclusion, the successful implementation of an exit strategy requires a meticulous approach, strategic thinking, and adaptability to evolving circumstances. Whether selling the business, merging, going public, or pursuing other exit options, the process demands careful planning, professional guidance, and a focus on long-term financial objectives. By addressing challenges, optimizing valuation, and considering post-exit considerations, stakeholders can navigate the complexities of the exit journey and achieve optimal outcomes.